USD Coin (USDC): Bridging Digital Assets and Stable Value

USD Coin (USDC) has emerged as a prominent stablecoin within the cryptocurrency market. Designed to maintain a stable value, USDC offers a digital representation of the U.S. dollar, providing users with a reliable and transparent bridge between traditional finance and the world of digital assets. In this article, we will explore the foundations of USD Coin, its mechanisms, use cases, and the impact it has had on the broader crypto ecosystem.

Read More

XRP (XRP): Transforming Cross-Border Payments and Financial Solutions

XRP (XRP) has emerged as a digital asset designed to revolutionize cross-border payments and enhance financial solutions. Developed by Ripple, XRP offers fast, efficient, and cost-effective transactions, enabling seamless global transfers of value.

In this article, we will delve into the intricacies of XRP, its unique features, use cases, and the impact it has had on the financial industry.

How to invest in cryptocurrency: A beginner's guide

Cryptocurrency has emerged as a popular investment option, capturing the attention of both seasoned investors and newcomers to the financial world. If you're a beginner interested in investing in cryptocurrency, this comprehensive guide is for you.

From understanding the basics of cryptocurrency and blockchain technology to choosing a cryptocurrency exchange and managing risks, we will provide step-by-step guidance on how to invest in cryptocurrency. By the end of this guide, you will have a solid foundation to start your cryptocurrency investment journey with confidence.

Read More

Strategies for investing in the artificial intelligence sector

Investing in the artificial intelligence (AI) sector offers exciting opportunities for investors seeking exposure to cutting-edge technology and innovation. This article delves into strategies for navigating the AI landscape, understanding key investment considerations, identifying promising AI companies, and managing risks effectively.

Read More

The benefits and risks of investing in emerging market bonds

Investing in emerging market bonds has become an increasingly popular strategy for investors seeking diversification and higher yields. Emerging markets offer unique opportunities, but they also come with their own set of risks. In this article, we will explore the benefits and risks associated with investing in emerging market bonds, helping you understand the potential rewards and challenges of this investment avenue.

Read More

The benefits and risks of investing in emerging market currencies

Investing in emerging market currencies can offer unique opportunities for diversification and potential returns. As economies in emerging markets grow and gain prominence in the global arena, their currencies become increasingly attractive to investors. However, investing in these currencies comes with its own set of benefits and risks. In this article, we will explore the advantages and risks of investing in emerging market currencies, helping you understand the potential rewards and challenges associated with this investment strategy.

Read More

The future of money Cryptocurrencies and digital assets

The world of money is evolving rapidly with the advent of cryptocurrencies and digital assets. These digital forms of currency are disrupting traditional financial systems and revolutionizing the way we transact and store value. In this article, we will explore the future of money and delve into the realm of cryptocurrencies and digital assets.

From the technology behind cryptocurrencies to their potential impact on the global economy, we will examine the opportunities, challenges, and implications of this rapidly growing digital revolution.

Read More

The role of fundamental analysis in stock selection

Fundamental analysis plays a crucial role in the process of selecting stocks for investment. By examining a company's financial health, evaluating its intrinsic value, and analyzing key qualitative factors, fundamental analysis provides investors with insights into the long-term prospects of a stock.

In this article, we will explore the importance of fundamental analysis in stock selection, its key components, and how it can help investors make informed investment decisions.

Read More

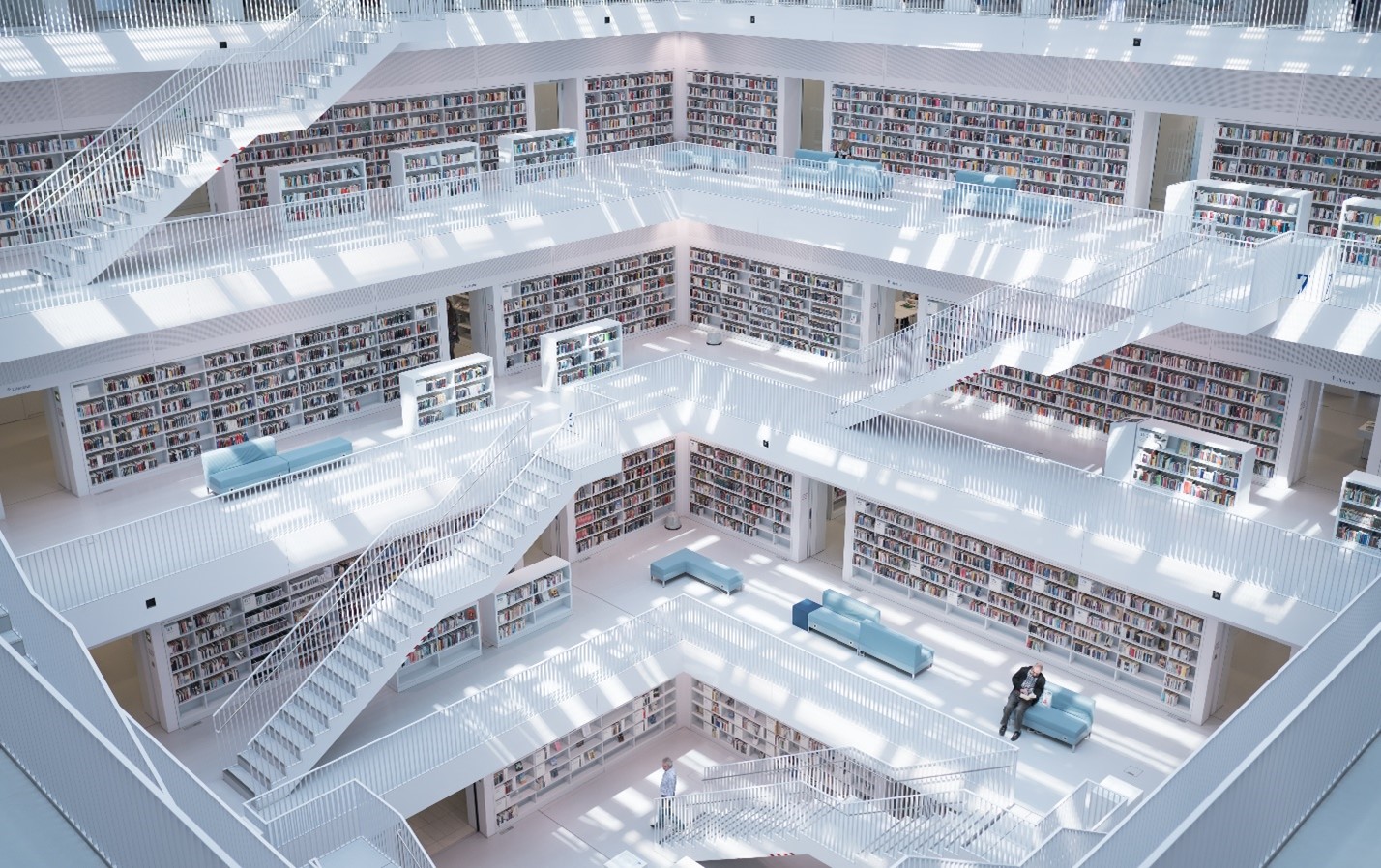

Top 10 books every investor should read

Reading is an essential activity for investors looking to enhance their knowledge and skills in the financial world. The right books can provide valuable insights, strategies, and perspectives from seasoned investors and financial experts. In this article, we present a curated list of the top 10 books that every investor should read.

From classic investment literature to modern-day gems, these books cover a range of topics, including value investing, behavioral finance, market analysis, and more. Whether you're a beginner or an experienced investor, these books will expand your understanding and help you navigate the complexities of the investment landscape.

Read More

Understanding the basics of stock investing: A beginner's guide

Stock investing is a powerful way to grow your wealth and achieve financial goals. However, for beginners, the world of stocks can seem complex and intimidating. In this beginner's guide, we will demystify stock investing and provide a comprehensive understanding of the basics.

From defining stocks and understanding market dynamics to analyzing risk and building a portfolio, this guide will equip you with the knowledge and confidence to embark on your stock investing journey.

Read More